18 B + PMTs Vol. / Rating 5.0, 8.0, 8.0

Mortgage S.I. coin sits on top of the stellar blockchain as a fungible and Interoperable cryptocurrency. Blockchain companies mitagate the risk of hacking and fraud by maintaining a transparent record of all the transactions of the digital currency. There is no chance of lost information or fake transactions.

Coupled with the certainty and availability of instant sales and purchases (on the spot transactions) for daily services, household items and durable goods puts “MORTG” squarely in the cash markets with a reliable, dependable and low transaction cost blockchain, providing a maximum level of protection.

The blockchain plays the role of authenticating every transaction that is made through, “MORTG” in the commodity cash market and encompasses big ticket items like housing, automobiles and major household applicances.The blockchain plays the role of authenticating every transaction that is made through, “MORTG” in the commodity cash market encompassing big ticket items like housing, automobiles and major household applicances.

As a fungible cryptocurrency on the internationally recognizes stellar network, Mortgage S.I. coin has guaranteed, low transaction fees and allows implementation of claimable balances whereby any transaction, including a third party like investors, brokers, or a privy party, can be efficiently secured in the transaction.

Domestic/International Uses

Mortgage S.I. cryptocurrency can be staked, in large real property security interest transactions as a stand alone equity for purchasing or trading a property, and or equivalent and paired with other cryptocurrencies in pools to generate daily, weekly and monthly trading fees.

Store of Value –Like precious metals.

Transfer / Move Money – Domestic and international money transfer (e.g., remittances) in order to increase efficiencies and potentially reduce related fees.

Financial Institutions Trading & Payment Platforms

Repurchase Agreement Transactions (“Repos,” i.e., short-term borrowing of securities).

Governments –General Records Management –Title & Ownership Records Management (e.g., real property deeds and title transfer). "

Resource / Asset Sharing Agreements (e.g., allowing rental of a personal car left behind during a vacation or allowing rental of excess computer or data storage)".

(Appended list)

..CFTC

Transparency

"MORTG” offers favorable conditions in any market phase allowing you to utilize property as defined by IRS Notice 2014-21 and California Probate Code Section § 6132 (h)(1) Section 798.3 of the Civil Code for one-off and continuous, on the spot transactions to any payee inclusive of escrow transactions as evident by widely known Bitcoin and altcoin purchases for real property.

The IRS virtual currencies (property) can be digitally traded between users and can be purchased for, or exchanged into, U.S. dollars, Euros, and other real or virtual currencies. That gives "MORTG" a seemless transaction occurrence in daily payments and escrow transactions.

IRS Notics 2014-21, IRB 2014-16) has determined that Mortgage S.I. coin as recognized ordinary income in exchange for performing services and in transactions, using spot/cash markets. Mortgage S.I. coin is a legally authorized instrument and can be utilized in any private or industry source of purchasing, transaction fees, renumeration, bonuses and or benefits.

Syndicated loans (Defi) "A syndicated loan is one where a group of financial individuals or institutions lend to a single borrower.

Mortgage S.I. loan syndication occurs when two or more lenders come together to fund one loan for the borrower in the course of the borrowers' operations. Syndicate handles loans that are too large for one individual or institution or falls outside the risk tolerance of a bank. The individuals or institutions in our loan syndicate share the risk and are only exposed to their portion of the loan.

How the Syndicate lends

1) Upon receiveing a loan application from the borrower, we ensure that the collateral is sufficient to cover losses if the borrower fails to repay the loan.

The Syndicate can create a lend application across the stellar P2P lending network. In that case, the borrower will submit their loan applications directly to Syndicate, via the lending network.

2) We make an offer to the borrower 3) After the borrower review and acceptance of the offer. We're notified if the borrower accepts the offer. 4) When the loan term ends which can be 24 hours, days, months or annually, the Syndicate claims repayment or the fungible collateral if the borrower fails to repay the loan.

Our risks?

Loans can be 100% collateralized but there risks involved in loan syndication:

1) The value of borrower collateral should be sufficient to recover the losses if the borrower fails to repay the loan.

2) The are no liquidations. If the borrower fails to repay the loan, the Syndicate receives the collateral asset. The Syndicate is responsible for selling/exchanging the fungible collateral to recover losses (collateral is subject to market fluctuations.)

.png)

Milestones

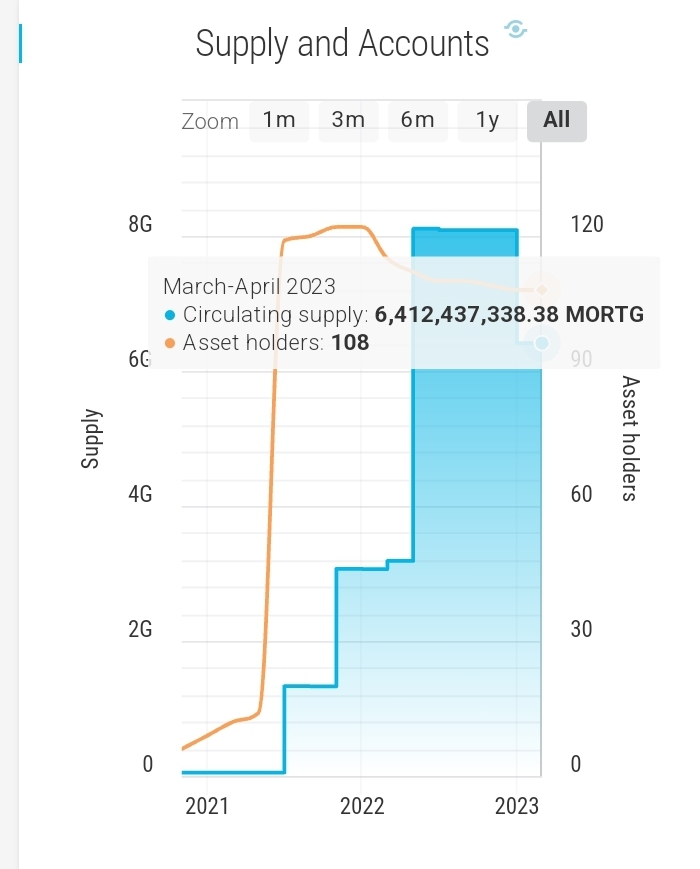

Mortgage S.i. was soft Launched in April 2022 on the on the stellar network. Mortgage S.I. coin was developed to be an easily recognizable fullfillment, obligation. New milestones include verified domestic and international swap operations, active order book market trading, a blossoming list of trading pairs, Protocol 18 compliant liquidity pools and growing interoperability.

Solving

Mortgage S.I. coin was developed to allow efficient large real property security interest transactions, in residential and commercial markets to avert defaults and property loss, by providing a Fannie Mae compliant alternative instrument when purchasing a residential or commercial property. It also functions as a staking tool in the real estate industry and general business market for use in liquidity pools to earn it's hodlers daily trading fees for the professional, intermediate and novice investor or property investor.

t.me/MortgageSIBot

@MortgageSIBott.me/Mortgage_SyndicateBot

@Mortgage_SyndicateBotAddress

2029 Century Park EUnited States of America